Saturday, April 17, 2010

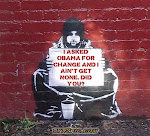

Why Tea Party Protesters Shouldn't Thank President, They Should Call Him a LIAR

"In the fifteen months of his presidency, President Obama has enacted into law, 25 tax increases totaling more than $670 billion, at least 14 of the taxes were violations of the Obama’s pledge not to raise any kind of taxes on Americans earning less than $200,000 for singles and $250,000 for married couples.

The President's list of violations include:

* Tobacco tax increase and expanded enforcement authority*

* New tax on individuals who do not purchase government‐approved health insurance

* A 40% excise tax on high-cost health insurance plans

* A new "medicine cabinet tax" on over-the-counter purchases from HSAs, FSAs, and HRAs increasing the non-medical early withdrawal HSA penalty from 10 to 20 percent

* A "special-needs kids" tax (capping FSA contributions at $2500)

* An increase in the top Medicare payroll tax rate from 2.9 to 3.8 percent (in so doing raising the top marginal tax rate on labor from 37.9 to 43.4 percent)

* A hike in the capital gains rate from 15 to 23.8 percent

* A hike in the dividends tax rate from 15 to 43.4 percent

* A hike in the "other" investment tax rate from 35 to 43.4 percent

* An increase in the "reduction of the deduction" for medical expenses from 7.5 to 10 percent of AGI

* New annual taxes on health insurance companies, innovator drug companies, and medical device manufacturers

* A 10% excise tax for tanning salon sessions eliminating the deduction for employer-provided retiree Rx coverage in coordination with Medicare Part D

* Creating the "economic substance doctrine," which allows the IRS to disallow perfectly-legal tax deductions it deems are only being used to reduce tax liabilities

* Requiring 1099-MISC information reporting for small business payments to corporations, increasing compliance burdens for small employers

The President's list of violations include:

* Tobacco tax increase and expanded enforcement authority*

* New tax on individuals who do not purchase government‐approved health insurance

* A 40% excise tax on high-cost health insurance plans

* A new "medicine cabinet tax" on over-the-counter purchases from HSAs, FSAs, and HRAs increasing the non-medical early withdrawal HSA penalty from 10 to 20 percent

* A "special-needs kids" tax (capping FSA contributions at $2500)

* An increase in the top Medicare payroll tax rate from 2.9 to 3.8 percent (in so doing raising the top marginal tax rate on labor from 37.9 to 43.4 percent)

* A hike in the capital gains rate from 15 to 23.8 percent

* A hike in the dividends tax rate from 15 to 43.4 percent

* A hike in the "other" investment tax rate from 35 to 43.4 percent

* An increase in the "reduction of the deduction" for medical expenses from 7.5 to 10 percent of AGI

* New annual taxes on health insurance companies, innovator drug companies, and medical device manufacturers

* A 10% excise tax for tanning salon sessions eliminating the deduction for employer-provided retiree Rx coverage in coordination with Medicare Part D

* Creating the "economic substance doctrine," which allows the IRS to disallow perfectly-legal tax deductions it deems are only being used to reduce tax liabilities

* Requiring 1099-MISC information reporting for small business payments to corporations, increasing compliance burdens for small employers

Subscribe to:

Comments (Atom)