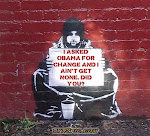

"War is Peace, Freedom is Slavery, Ignorance is Strength, and Debt is Recovery

"In light of the ever-present and unyieldingly persistent exclamations of ‘an end’ to the recession, a ‘solution’ to the crisis, and a ‘recovery’ of the economy; we must remember that we are being told this by the very same people and institutions which told us, in years past, that there was ‘nothing to worry about,’ that ‘the fundamentals are fine,’ and that there was ‘no danger’ of an economic crisis.

"Why do we continue to believe the same people that have, in both statements and choices, been nothing but wrong? Who should we believe and turn to for more accurate information and analysis? Perhaps a useful source would be those at the epicenter of the crisis, in the heart of the shadowy world of central banking, at the global banking regulator, and the 'most prestigious financial institution in the world,' which accurately predicted the crisis thus far: The Bank for International Settlements (BIS). This would be a good place to start.

"The economic crisis is anything but over, the 'solutions' have been akin to putting a band-aid on an amputated arm. The Bank for International Settlements (BIS), the central bank to the world’s central banks, has warned and continues to warn against such misplaced hopes."

and read this carefully:

"In May, the information that leaked from the meetings regarded the main topic of conversation being, unsurprisingly, the economic crisis. The big question was to undertake 'Either a prolonged, agonizing depression that dooms the world to decades of stagnation, decline and poverty ... or an intense-but-shorter depression that paves the way for a new sustainable economic world order, with less sovereignty but more efficiency.'

"Important to note, was that one major point on the agenda was to 'continue to deceive millions of savers and investors who believe the hype about the supposed up-turn in the economy. They are about to be set up for massive losses and searing financial pain in the months ahead.'

"Estulin reported on a leaked report he claimed to have received following the meeting, which reported that there were large disagreements among the participants, as 'The hardliners are for dramatic decline and a severe, short-term depression, but there are those who think that things have gone too far and that the fallout from the global economic cataclysm cannot be accurately calculated.' However, the consensus view was that the recession would get worse, and that recovery would be 'relatively slow and protracted,' and to look for these terms in the press over the next weeks and months. Sure enough, these terms have appeared ad infinitum in the global media.

"Estulin further reported, 'that some leading European bankers faced with the specter of their own financial mortality are extremely concerned, calling this high wire act "unsustainable," and saying that US budget and trade deficits could result in the demise of the dollar.' One Bilderberger said that, 'the banks themselves don't know the answer to when (the bottom will be hit).' Everyone appeared to agree, 'that the level of capital needed for the American banks may be considerably higher than the US government suggested through their recent stress tests.' Further, 'someone from the IMF pointed out that its own study on historical recessions suggests that the US is only a third of the way through this current one; therefore economies expecting to recover with resurgence in demand from the US will have a long wait.' One attendee stated that, 'Equity losses in 2008 were worse than those of 1929,' and that, 'The next phase of the economic decline will also be worse than the '30s, mostly because the US economy carries about $20 trillion of excess debt. Until that debt is eliminated, the idea of a healthy boom is a mirage.'"

Saturday, October 3, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment